Content

Matt writes a weekly investment column („Ask a Fool”) that is syndicated in USA Today, and his work has been regularly featured on CNBC, Fox Business, MSN Money, and many other major outlets. He’s a graduate of the University of South Carolina and Nova Southeastern University, and holds a graduate certificate in financial planning from Florida State University. I recommend exchanges that have state money transmitter licenses and the NY Bitlicense or other state or Federal licenses/charters, including, but not limited to, Gemini, Kraken, or Square.

Technically, Robinhood is a cryptocurrency broker, while exchanges like Coinbase Pro are crypto exchanges. One of the most frequently asked questions when it comes to trading in crypto is, should I trade on cryptocurrency exchanges or should I trade with the crypto broker? Simply put if you want to keep your coins for a longer time, you need to go for the exchange Coinbase, Binance, or any other crypto exchange. If you want to speculate and how to become a cryptocurrency broker buy and sell quickly, then you need to go to a crypto broker who offers advisory or brokerage services. As always in the world of cryptocurrencies, make sure that you are protecting yourself against scams and money laundering which are both frequent occurrences in the crypto sphere. Bitpanda Pro holds a PSD2 payment service provider licence and is fully compliant with the provisions of the EU’s fifth anti-money laundering directive .

It provides users with a variety of different cryptocurrency tokens and offers a service known as Coinbase Pro, which tries to list new cryptocurrency altcoins. The first thing you need to do is select the cryptocurrency brokerage that you will be using based on your own research. In order to create an account, you will usually have to find a button on the official homepage that prompts you to „Sign Up” or „Join Now.” This will forward you to the account creation screen. Here, you will be required to enter some general information, such as an email, password, and username. Additionally, many regulated cryptocurrency brokerages out there will also require you to complete a know-your-customer verification process, which will require relevant documents on your end. Although many exchanges have great security features, there have been several crypto exchange hacks in the last few years.

- Basic users can earn up to a 1.2% yearly savings bonus on balances up to $5,000 and Metal users now earn a 2.15% yearly savings bonus on balances up to $100,000.

- So if the price falls from $10,000 to $6,000, if we sell on $10,000, we will benefit from this difference of $4,000.

- These include brokers, exchanges, and apps you can use to start building your own cryptocurrency portfolio today.

- Today, with an exchange in almost every country, stock exchanges provide vast marketplaces for the buying and selling of currencies and commodities across the globe.

- If you got it right about the future price movements and Bitcoin grows higher within the lifespan of the CFD, the broker pays you the difference.

- We considered these factors when selecting this list of the best cryptocurrency exchanges.

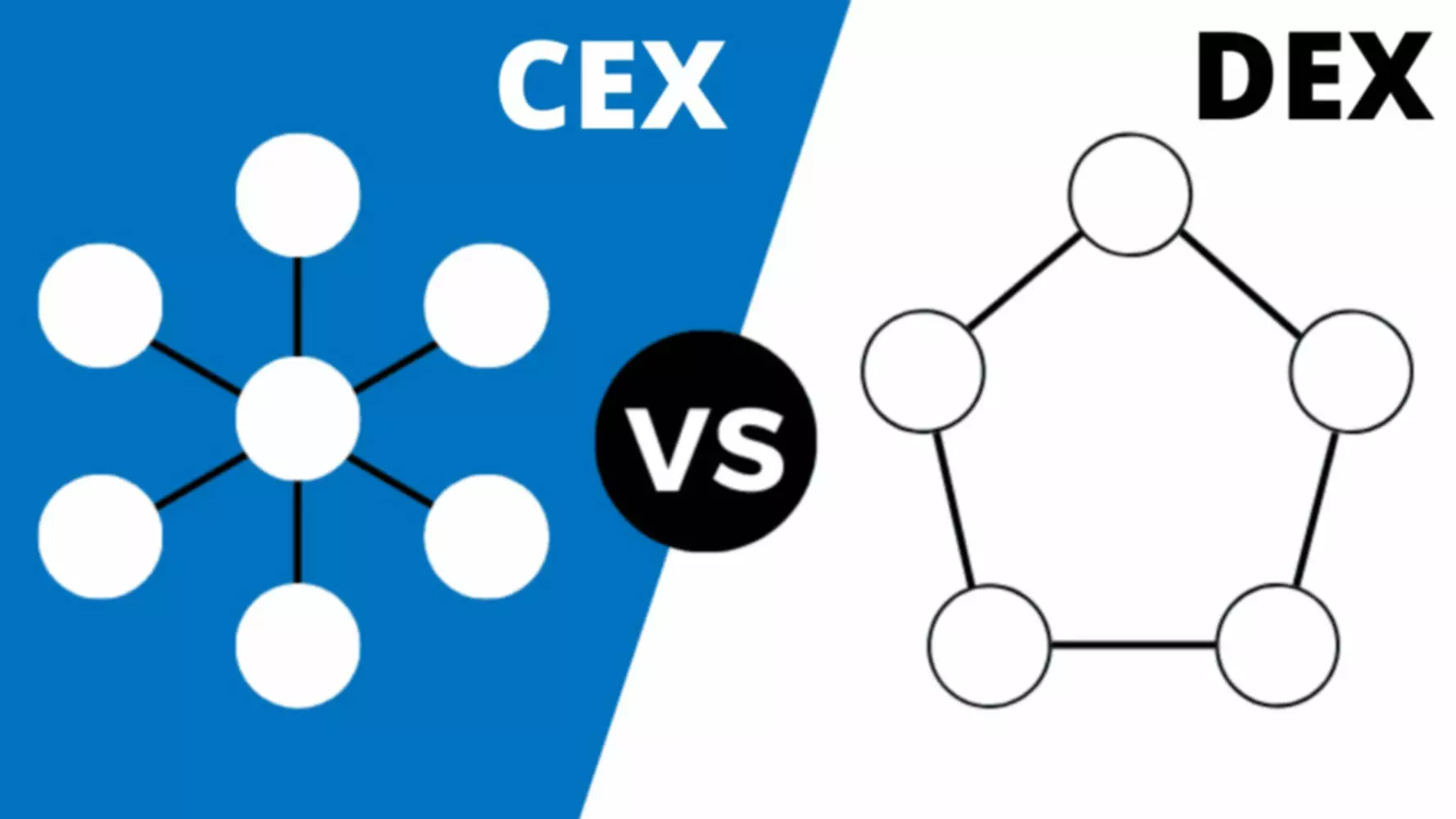

Crypto exchanges can be centralized, meaning they are managed by one corporate authority, like a brokerage company that facilitates the security of trades, or decentralized. If you’re just getting started with cryptocurrency, look for an easy-to-use platform with plenty of educational resources to help you understand this complex, rapidly developing market. While you’re ideally picking an exchange with the lowest costs, dwelling too much on the ins and outs of maker and taker fees can be counterproductive.

Coinbase: Best Learning Rewards Program

Several of the best stock brokers now offer cryptocurrency trading through their platforms. You can, of course, create a very strong password and even enable 2-factor authentication, but, unluckily, this cannot guarantee 100% safety of funds. Besides, each crypto exchange security level is different, and one can’t tell what is going to happen going forward. Lately, news on hacking and robbing client funds appear everywhere.

Brokerages can also provide you with a higher level of customer support relative to exchanges. Basic users can earn up to a 1.2% yearly savings bonus on balances up to $5,000 and Metal users now earn a 2.15% yearly savings bonus on balances up to $100,000. All you need to do to become a Metal user is to direct deposit at least $250. Because Caleb & Brown is an Australian firm, you also have access to XRP, TFuel and Theta, where U.S. exchanges do not. Talk to your broker about paying for college, retiring, saving for major purchases, planning vacations and much more. Stock and crypto prices have been following the same patterns a little too closely this year.

On the other hand, crypto exchanges are geared toward serious investors and traders that are looking for a wider selection of coins and the lowest conversion fees. In addition, crypto exchanges are suitable for frequent high-volume trades with fee discounts based on higher trade volumes or staking the platform’s native tokens. Built with advanced traders in mind, Gemini provides a professional-grade trading dashboard and supports over 100 digital currencies and tokens. Gemini also offers a cryptocurrency reward card and allows users to pay for goods and services with crypto. The main thing to remember is that this industry — the coins, the platforms, the blockchains, the exchanges, the wallets — is largely unregulated.

If you wish to exchange with another user on the platform, the exchange takes place between not only the two users, but also the platform itself in order to ensure a safe transaction. You can also exchange fiat currencies this way for a cryptocurrency whether you are using Euro, USD, GPB, or whichever fiat currency. Generally speaking, crypto brokers are individuals or firms that act as financial intermediaries for people that wish to exchange their crypto currency for a different one of for money. Usually, they would charge some kind of premium for the use of their platform. Trading rate fluctuations and investing are the two most common ways crypto brokerages offer to increase profits.

Crypto Brokers And Exchanges

The Commodity Futures Trading Commission now permits the trading of cryptocurrency derivatives publicly. A common approach to cyber money laundering was to use a digital currency exchanger service which converted dollars into Liberty Reserve and could be sent and received anonymously. The receiver could convert the Liberty Reserve currency back into cash for a small fee. More than $40 million in assets were placed under restraint pending forfeiture, and more than 30 Liberty Reserve exchanger domain names were seized.

What is Crypto Leverage Trading? – Cryptopolitan

What is Crypto Leverage Trading?.

Posted: Thu, 13 Oct 2022 18:24:15 GMT [source]

You would essentially sacrifice a wider range of investments and account features for lower fees and limited cryptocurrency options. If you’re looking for a wider range of crypto-specific trading tools and account features, a cryptocurrency exchange may be the best option. A broker’s client has a large number of ways to make a deposit, including credit cards, popular e-wallets, etc. You can deposit US dollars, euros, and sometimes other currencies. This simplifies the whole process a lot, while, as a rule, there are no deposit fees whatsoever. In some of the largest crypto exchanges the signup process is closed, but where it’s still available, the process is as simple as registration on other websites.

Types Of Crypto Exchanges

Cryptocurrencies are designed to exchange information digitally through a distribution system called a blockchain. Given the maturity of the stock exchange and the myriad rules and regulations that have developed around it, the process to begin trading can be time consuming and energy intensive. Large trade volumes increase the stock market’s stability and make it less prone to the movements of 'big fish’ traders. That said, given its connections with governments and corporations all across the globe, the stock exchange is frequently impacted by geopolitical events.

The smallest amount of cryptocurrency you can buy is $10 worth, and the trading fees are up to 0.5%, while the fee for withdrawals depends on the coin. Bitstamp keeps 98% of its assets in offline cold wallet storage as part of its industry-leading security practices. It also provides transaction confirmations, address whitelisting, and strong encryption of personal information. You can trade CFDs with up to 30x leverage on Capital.com, and there are plenty of advanced tools and features to satisfy experienced traders.

If you’re looking for the best cryptocurrency brokers, we also have an article on that. Most exchanges have both desktop and mobile applications, so we’ve weighed both in our review. Interactive Brokers provides active crypto traders with numerous advantages over competitors. Did you know that most crypto exchanges charge a spread on your buy or sell orders? Luckily, Interactive Brokers charges no added spreads, markups, or custody fees and low commissions from just 0.12% to 0.18% of the trade value. Interactive Brokers currently offers Bitcoin, Bitcoin Cash, Ethereum, Litecoin, and more digital token from Paxos Trust Company.

Best Crypto Exchanges Compared

Normally a government-issued currency such as the U.S. dollar is one of the assets involved in the trade, but it doesn’t need to be. For example, when you buy bitcoin with dollars you are converting your dollars into bitcoin. Both brokerages and exchanges can offer any type of asset pair and can operate during whatever hours they choose.

It was just that stone falling down and with the crypto brokers, you have the option to sell even if you haven’t bought it previously. At the crypto broker, we trade CFD contracts, which is called so because it stands for Contract For Difference. Contract For Difference means that every time we buy a Bitcoin, we make a contract with the broker that if the price goes up, we will benefit from that difference.

Traders on exchanges are more at risk of slippage because they lack the price guarantee that a brokerage offers. A brokerage is always taking the other side of the trade, so they can be more flexible with the settlement of assets. Many brokerages will allow traders to lock in a trade at a certain price even if they are unable to pay for the asset immediately. This is useful for traders who decide to trade an asset on short notice or would prefer to keep their assets elsewhere until they are traded. With brokerages, liquidity is determined by the brokerage itself, not other traders in the market.

There are various cryptocurrency brokers on the internet such as Bitpanda for example. They are the best option for beginners, as you can very easily and safely purchase some Bitcoin, Litecoin, Ethereum, and whichever other cryptocurrency you might be interested in. This article does not constitute investment advice, nor is it an offer or invitation to purchase any crypto assets. Several incidents have happened to crypto exchanges, such as hacking KuCoin, Mt.Gox, and several others. Even the major ones, like Binance, are often targets of scammers and cyber criminals, who attack their KYC database, websites, and many more. Another global issue with crypto exchanges is that they are typically not governed by laws or regulations.

We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products. Please don’t interpret the order in which products appear on our Site as any endorsement or recommendation from us.

How We Chose The Best Crypto Exchanges

An exchange’s jurisdiction reflects not only their target market, but also where they’re allowed to do business due to certain cryptocurrency regulations. Learn more about the different types of exchanges, how a crypto exchange works with your crypto wallet, and how to decide which type of exchange is best for you. Yes, you can buy Bitcoin from any well-known crypto exchanges as well as Bitcoin brokers. Binance is the largest crypto broker for spot trading according to the daily trading volume and liquidity. However, Coinbase has more verified users, according to the platform website.

To keep your data secure, BlockFi uses tools such as two-factor authentication and allowlisting, which lets users ban withdrawals or restrict them to certain addresses to avoid theft. Where most crypto exchanges offer bonuses and discounts for high-volume trading, BlockFi has chosen to create financial products that cater to conservative traders instead. Binance is the world’s largest cryptocurrency exchange by trading volume, and its United States partner, Binance.US, offers many of the former’s advantages. One of its greatest assets is a competitive maker/taker fee structure that tops out at 0.1%. This fee starts low and keeps getting lower as your trading volume increases.

Our Top Picks For The Best Crypto Exchanges Of October 2022

Insider’s experts choose the best products and services to help make smart decisions with your money (here’s how). In some cases, we receive a commission from our our partners, however, our opinions are our own. Frank has turned his hobby of studying and writing about crypto into a career with a mission of educating the world about https://xcritical.com/ this burgeoning sector of finance. He worked in Ghana and Venezuela before earning a degree in applied linguistics at Teachers College, Columbia University. He taught writing and entertainment business courses in Japan and worked with UNICEF in Nambia before returning to the States to teach at universities in New York City.

A cryptocurrency exchange facilitates the purchase and sale of cryptocurrencies only. It might allow users to buy and sell cryptocurrencies as well as stocks, mutual funds, and other types of investments. Most of the top cryptocurrency exchanges keep the bulk of their digital assets in „cold storage.” This means they are stored offline and aren’t at risk of being hacked or stolen. In the earlier days of cryptocurrencies, there was a risk of exchanges being hacked, but these issues have largely been dealt with. As we saw above, you can’t currently withdraw your digital assets from traditional brokerages that are trading cryptocurrencies. The exchanges usually charge a set fee depending on the currency you want to withdraw.

Brokers let clients trade cryptos as CFDs, meaning there are not many crypto assets available. What gives crypto brokers credit and reliability is that they are under government control, meaning nobody can bypass their regulations. You can freely use bank accounts, credit cards, and e-wallets, and sometimes, the most advanced brokers allow crypto transfers. In early 2018, Bloomberg News reported the largest cryptocurrency exchanges based on the volume and estimated revenues data collected by CoinMarketCap. Similar statistics was reported on Statista in a survey by Encrybit to understand cryptocurrency exchange problems. According to the survey, the top three cryptocurrency exchanges are Binance, Huobi, and OKEX.

As a reminder, cryptocurrencies are speculative, complex, and involve significant risks. Please verify the nature of any product or service and consider your own circumstances before making any decision. There are lots of fees to take into account when choosing an exchange. Exchanges like Kraken and FTX.US are known for having competitive transaction fees.